Context

In order to provide credit to rural consumers, the government is planning to leverage the 15,000-odd strong network of the 43 Regional Rural Banks (RRBs) in the country by asking them to expand their portfolio by adding new segments.

Where would the extended credit go?

- The proposed mandate will require RRBs to go beyond their mainstay of agricultural loans to extending credit for education, housing and even small businesses in rural India.

- The initiatives and targets will be part of the Enhanced Access & Service Excellence (EASE) reforms being undertaken by the Centre. EASE reforms were launched in 2018 for the public sector banks and are currently in their fifth phase.

EASE Reforms

- EASE reforms were launched in 2018 for the public sector banks and are currently in their fifth phase.

- The basic objective of EASE is to institutionalize clean lending, better customer service, simplified and enhanced credit and robust governance and human resource practices.

- The EASE Reforms Index tracks the progress of the PSBs against the PSB reforms agenda.

- Through the EASE Reforms Index, the performance of the PSBs is measured on 140 metrics against their respective benchmarks to chalk out a mechanism for continuous improvement.

|

Reason behind the move

- The Department of Financial Services has flagged concerns about public-sector banks having slowed lending to education loans due to higher defaults and the continuing struggle of the Micro Small and Medium Enterprise sector which suffered the most in the wake of the Covid-19pandemic and national and local lockdowns.

About Regional Rural Banks

- RRBs came into being in 1975.

- They are government owned scheduled commercial banks of India that operate at regional level in different states of India.

- These banks are under the ownership of Ministry of Finance, Government of India.

- They were created to serve rural areas with basic banking and financial services.

- Each RRB in the country has a PSB as its sponsor bank.

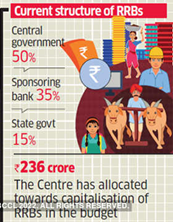

- The RRBs are jointly owned by the

- central government- 50%

- state government- 15%

- sponsoring bank- 35%

|