Microfinance industry to face asset quality pressures amid restrictions

- Posted By

10Pointer

- Categories

Economy

- Published

26th Apr, 2021

-

-

Context

ICRA (Investment Information and Credit Rating Agency of India) in its report has said that microfinance and unsecured SME loan pools would likely face the most stress if case severity of the second COVID- 19 wave increases.

-

Background

- A large chunk of the population remains outside the formal banking system.

- Microfinance institutions are equipped to reach the 'unbankable' or 'unbanked' segment of the population, and make financial services accessible to them.

- Micro-finance institutions (MFIs) are allowed to function like banks in the present state of partial lockdowns as they perform an essential service for the poor.

-

Analysis

History of Microfinancing

- The term “microfinancing” was first brought to significance during the 1970s when the development of the Grameen Bank of Bangladesh took place. It was founded by the microfinance pioneer, Muhammad Yunus.

- In 1976, Yunus institutionalized the approaches of microfinance, along with laying the foundation of the Grameen Bank in Bangladesh.

-

Types of Microfinance

- Microloans: Microfinance loans are significant as these are provided to borrowers with no collateral. The end result of microloans should be to have its recipients surpasses smaller loans and be ready for traditional bank loans.

- Micro savings: Micro savings accounts allow entrepreneurs to operate savings accounts with no minimum balance. These accounts help users to imbibe financial discipline and develop an interest in saving, which can secure their future.

- Microinsurance: Microinsurance is a type of coverage provided to subscribers of microloans. These insurance plans have lower premiums than regular insurance policies.

-

Microfinance Channels

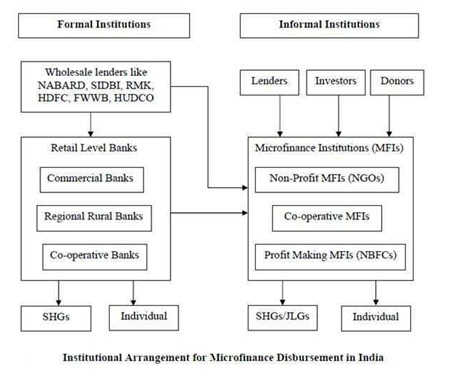

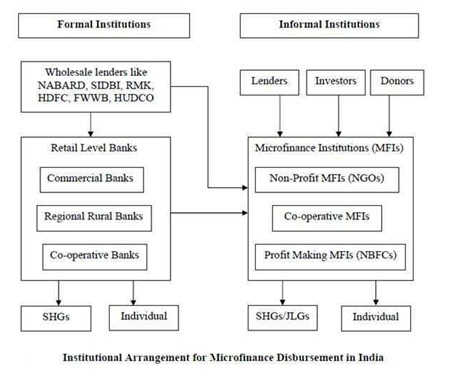

Microfinance in India operates primarily through two channels:

- SHG-Bank Linkage Programme (SBLP) - This channel was initiated by NABARD in the year 1992. This model encourages financially backward women to come together to form groups of 10-15 members. SHGs are also offered bank loans at later stages, which can be used for funding income-generating activities.

- Microfinance Institutions (MFIs) - These institutions have microfinance as their primary operation. In this, the lending is made through the concept of Joint Liability Group (JLG),which is an informal group that consists of 5-10 members who seek loans either jointly or individually.

-

Major Business Models:

- Joint Liability Group:This is usually an informal group that consists of 4-10 individuals who seek loans against the mutual guarantee.The loans in these categories are usually taken for agricultural purposes or associated activities.

- Self Help Group:It is a group of individuals with similar socio-economic backgrounds.These small entrepreneurs come together for a short duration and create a common fund for their business needs. These groups are classified as non-profit organisations.The National Bank for Agriculture and Rural Development (NABARD) SHG linkage programme is significant in this regard, as several Self-Help Groups can borrow money from banks if they canshow a track record of diligent repayments of loan taken.

- Grameen Model Bank:It was the brainchild of Nobel Laureate Prof. Muhammad Yunus in Bangladesh in the 1970s.It has an important role in inspiring the creation of Regional Rural Banks (RRBs) in India. The primary aim of this system is the end-to-end development of the rural economy.

- Rural Cooperatives:They were established in India at the time of Indian independence.However, this system had cumbersome monitoring structures and was beneficial only to the creditworthy borrowers in rural India. Hence, this system did not find the success that it was expecting initially.

-

What are the benefits of a robust Microfinance industry?

- They provide hustle free credit and offer small loans to customers, without any collateral.

- It makes more money available to the poor sections of the economy, leading to increased income and employment of poor households.

- It serves the under-financed section such as women, unemployed people and those with disabilities.

- It helps the poor and marginalised section of society by making them aware of the financial instruments available for their help and also helps in developing a culture of saving.

- Over the past decade, India’s microfinance industry has grown at a compound annual growth rate of 26% to reach ?2.36 trillion. It has helped around 50 million people who are economically vulnerable Indians, 99% of them women, live a life of dignity and financial independence.

- Assuming that if these 50 million people who had taken a loan to start a small business employed at least one other person, it results in 50 million additional jobs in the country. This creates a ‘network effect’ that has a social impact at scale.

-

Current Scenario

- The microfinance industry, which is closing towards pre-Covid levels in terms of disbursements of funds as well as the quality of portfolio – now seems a little cautious of the impact of the sudden increase in Covid-19 cases on its collection efficiency.

- Due to increasing Covid cases in April, the state governments have been bringing restrictions to control it. This is resulting in concerns over the asset quality of retail loans of non-banking financial companies.

- According to credit rating agency ICRA, Microfinance and unsecured SME loan pools are likely to come under stress among retail loans if the level of severity of lockdowns increases.

- Disbursements to new customers may get affected if a disruption in field operations occurs due to an increase in restrictions in certain regions, including Maharashtra, Tamil Nadu, and Odisha. This means that the overall credit supply to the sector might get affected.

- An increase in restrictions and or a longer lockdown is worrying for the industry as it would affect the field activity and thereby affect collections.

- The disturbance caused in economic activity by such lockdown restrictions will badly impact the cash flows of the borrowers and, hence, the collection efficiency gains witnessed in the past few months may start disappearing.

- Most of the microfinance institutions have reported more than 90 per cent recovery and some of them have even met their recovery target as of March 2021.

- As MFIs are categorised as essential services, the operations are going on as usual, without any adverse impact on collection efficiency.

- The restrictions on movement due to COVID-19 restrictions would have an impact on collection efforts for the NBFCs, especially for microfinance loans where cash collections remain dominant.

-

Performance during the Covid-19 times

- If we look at the profile of the customer e.g., flour grinding machine, selling vegetables, grocery shop, agriculture. Mostly these are the services that will continue, even during the lockdown. This is the reason that even during the first COVID-19 wave and despite the moratorium, the client activation level in the industry has reached 95 per cent plus and the recovery are currently 90 per cent.

- Credit enquiry in terms of Sectoral breakup: They are similar to pre-covid times, the total disbursement of microfinance sector which includes NBFC, MFI, Banks which are active in microfinance and small finance banks is touched roughly around Rs 60000 crores.

- Liquidity is a concern for smaller players because at this time of stress the clients in rural areas need some relief to strengthen their livelihood as liquidity continues to flow.

-

Significance of microfinance to the economy

- Microfinance has a significant role because it provides resources and access to capital for those who are financially underserved, such as those who are unable to get checking accounts, lines of credit, or loans from traditional banking institutions.

- Without microfinance, these groups may have to fall back on using loans or payday advances with extremely high interest rates or even borrow money from family and friends. Microfinance provides them with the opportunity to invest in their businesses, and as a result, invest in themselves.

-

What does the ICRA report say?

- The microfinance industry is presumably to face asset quality pressures due to the recent increase in COVID-19 infections and localised restrictions.

- Most of the microfinance institutions (MFIs) will be able to hold out against any stress due to their improving collection efficiency and good on-balance sheet liquidity. Still, a lot depends upon how long the second wave is going to stay.

- Though the near-term outlook for MFIs is obscured due to the COVID-19 brought disruptions, the overall long-term growth outlook for the domestic microfinance industry, including MFIs and micro finance-focused small finance banks (SFBs),appears to remain robust.

- The collection efficiency (total collections/scheduled demand) of the sector has improved to around 102% in December 2020. It is expected that the disbursements also started picking up momentum from the second quarter of FY2021, which is expected to help the MFI industry achieve growth of 9-11% in its assets under management (AUM) in FY2021.

| Assets under management (AUM) is the cumulative market value of the investments that a person or entity manages on behalf of its clients. |

- The liquidity flow to the sector has tweaked over the last few months and around Rs 22,900 crore was raised in the first nine months of FY2021. The industry has also witnessed a reduction in the overall cost of funds during this period. Still, the industry is expected to observe a reduction in net interest margins (NIMs).

| Net interest margin (NIM) is a measure of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders (for example, deposits), relative to the amount of their (interest-earning) assets. |

- Despite the reduction in the cost of funds in the first nine months of FY2021, the operating profitability is anticipating to decline, which along with the rise in credit costs would suppress the returns for FY2021.

-

Conclusion:

Microfinance can support income-generating activities and impact livelihoods in both rural and urban areas. The pick-up in AUM growth in FY2022, along with the increase in provision cover in FY2021, is expected to drive profitability upwards in FY2022, but it will be more likely to remain below the pre-COVID profitability level. Vaccinations for employees and self-help group workerswill ensure that lines of credit remain open for the poor amidst the rising second wave of COVID-19 infections. At present, the restrictions are localized and less harsh, but the severity seems to be gradually increasing as we are observing a surge in Covid-19 cases. If things take a different course, then it may negatively affect the sector.