Context

In a bid to break the deadlock over the launch of Surety Bonds, the Ministry for Road Transport & Highways (MORTH) has asked insurance regulator IRDAI to develop a model product on Surety Bonds in consultation with general insurers.

What is a ‘surety bond’?

- A surety bond is a mechanism to transfer risk for businesses.

- It assures the project owner (typically a government entity) that the assigned contractor will perform the task as per the contract clause.

- The surety company pays the project owner the promised amount (as per the contract) in the event of a default.

- The company charges a fee to the contractor to write the surety bond.

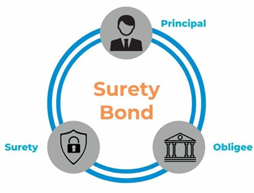

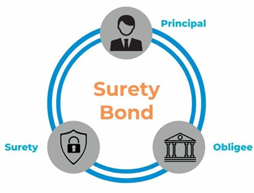

Parties to a Surety Bonds

A surety bond involved three parties:

- Obligee: It refers to the person or company protected by such a bond. This party is the beneficiary of the assurance.

- Principal: The principal is the person or company who has to fulfill the obligation (to accomplish a task or refrain from doing it). The principal purchases a surety bond to assure the obligee.

- Surety: It is an insurance company that backs a business contract. They issue bonds—a form of indemnification.

Thus, the surety assures the obligee that the principal will successfully complete the documented obligations. If the principal fails, the surety compensates the obligee for the incurred losses.

Type of Surety Contracts

- Advance Payment Bond: It is a promise by the Surety provider to pay the outstanding balance of the advance payment in case the contractor fails to complete the contract as per specifications or fails to adhere to the scope of the contract.

- Bid Bond: It is an obligation undertaken by a bidder promising that the bidder will, if awarded the contract, furnish the prescribed performance guarantee and enter into contract agreement within a specified period of time. It provides financial protection to an obligee if a bidder is awarded a contract pursuant to the bid documents, but fails to sign the contract and provide any required performance and payment bonds, as per the Irdia press release.

- Contract Bond: It provides assurance to the public entity, developers, subcontractors and suppliers that the contractor will fulfil its contractual obligation when undertaking the project. Contract bonds may include: Bid Bonds, Performance Bonds, Advance Payment Bonds and Retention Money.

- Customs and Court Bond: This is a type of guarantee where the obligee is a public office such as tax office, customs administration or the court, and it guarantees the payment of a public receivable incurred from opening a court case,clearing goods from customs or losses due to incorrect customs procedures.

- Performance Bond: It provides assurance that the obligee will be protected if the principal or contractor fails to perform the bonded contract. If the obligee declares the principal or contractor as being in default and terminates the contract, it can call on the Surety to meet the Surety’s obligations under the bond.

- Retention Money: It is a part of the amount payable to the contractor, which is retained and payable at the end after successful completion of the contract.

Benefits

- By issuing the surety bond, the contractor does not have to furnish a hefty bank guarantee.

- The bank guarantee blocks a huge amount.

- Surety bonds create a level playing field, empower the small and medium contracts to bid for a project at par with a large contractor with financial muscle.