National Monetisation Pipeline

- Posted By

10Pointer

- Categories

Economy

- Published

26th Aug, 2021

-

Context

The Centre launched the National Monetisation pipeline (NMP) in an effort to list out the government’s infrastructure assets to be sold over the next four-years.

Key-Points

- NMP aims to unlock value in brownfield projects by engaging the private sector, transferring to them revenue rights and not ownership in the projects.

- Ownership of the brownfield assets to remain with the government.

- The generated funds will be used for infrastructure creation across the country.

What is brownfield project India?

- A brownfield is an investment when a company or government entity purchases or leases existing production facilities to launch a new production activity.

|

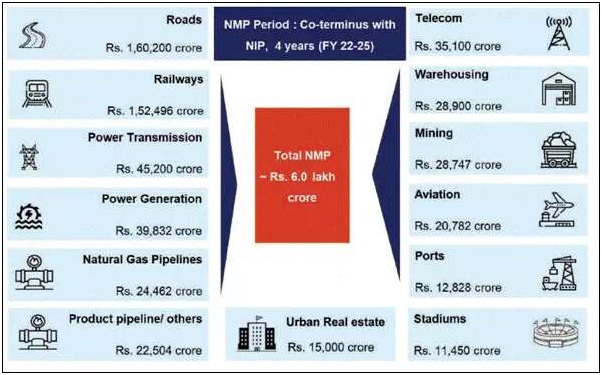

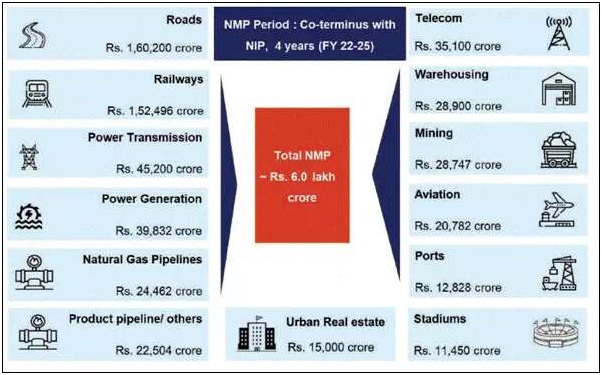

Major sectors

- Roads, railways and power to be priority sectors.

- Roads, railways and power sector assets will comprise over 66% of the total estimated value of the assets to be monetised, with the remaining upcoming sectors including

- telecom

- mining

- aviation

- ports

- natural gas and petroleum product pipelines

- warehouses

- stadiums

Estimated fund allocation

- NMP is indicatively valued at Rs 6.0 lakh crore for 4 years for FY 2022-2025.

Significance of the scheme

- The NMP document is a critical step towards making India’s Infrastructure truly world class.

- Assets monetisation needs to be viewed not just as a funding mechanism, but as an overall paradigm shift in infrastructure operations, augmentation and maintenance considering the private sector’s resource efficiencies and its ability to dynamically adapt to the evolving global and economic reality.

- Such new models will enable not just financial and strategic investors but also common people to participate in this asset class thereby opening new avenues for investment.

Challenges to National Monetisation pipeline (NMP)

- Lack of identifiable revenue streams in various assets

- Level of capacity utilisation in gas and petroleum pipeline networks

- Regulated tariffs in power sector assets

- Low interest among investors in national highways below four lanes