Banking System Liquidity turns to deficit mode

- Posted By

10Pointer

- Categories

Economy

- Published

26th Sep, 2022

-

Context:

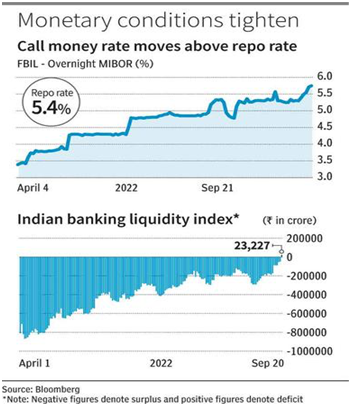

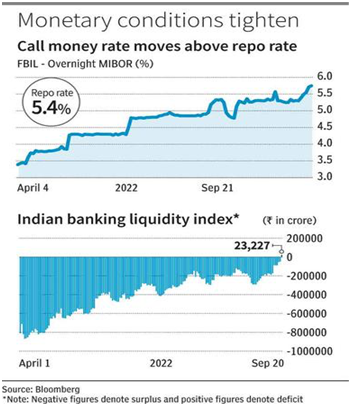

For the first time Liquidity in the banking system has moved into deficit mode after remaining in surplus mode for almost 40 months for the first time since May 2019.

About banking system liquidity

- Liquidity in the banking system refers to readily available cash that banks need to meet short-term business and financial needs.

- On a given day, if the banking system is a net borrower from the RBI under Liquidity Adjustment Facility (LAF), the system liquidity can be said to be in deficit and if the banking system is a net lender to the RBI, the system liquidity can be said to be in surplus.

- The LAF refers to the RBI’s operations through which it injects or absorbs liquidity into or from the banking system.

What has triggered this Deficit?

- The change in the liquidity situation has come due to advance tax outflows. This also increases the call money rate temporarily above the repo rate.

- Call money rate is the rate at which short term funds are borrowed and lent in the money market.

- Banks resort to these types of loans to fill the asset liability mismatch, comply with the statutory CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio) requirements and to meet the sudden demand of funds. RBI, banks, primary dealers etc. are the participants of the call money market.

- Besides, there is the continuous intervention of the RBI to stem the fall in the rupee against the US dollar.

- The deficit in the liquidity situation has been caused by an uptick in bank credit, intervention of the RBI into the forex market, and also incremental deposit growth not keeping pace with credit demand.