The world at present is moving ahead with a rapid pace of development. Enhanced use of technology and digitalization have touched upon most aspects of this fast journey. The use of internet has highly increased the avenues for doing business by removing the requirements for physical presence in a country for delivery of goods or services.

This has indeed transformed the global economy. At the same time, it has given rise to several questions related to ‘taxation’ of the consideration/income generated by using the digital platforms for conduct of business. The present global taxation system is based on the traditional ‘brick and mortar’ system of business environment. But the modern business practices based on digital economy have rendered it necessary to find modern solutions for an effective global taxation regime.

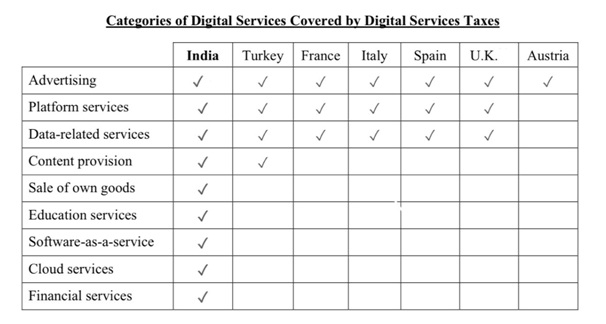

Several countries have come together at the global level to find a unified solution to the new challenges. The objective of such discussionshas been to develop new standards for offering a global roadmap to governments for collection of tax revenue, and at the same time providing businesses the certainty needed to invest and expand.

The ‘OECD/G20 Inclusive Framework on BEPS’is one of the most important platforms at present for discussion on norms on global economy. Under this framework, the tax challenges raised by digitalization is currently the top most priority. Discussions have been going on since 2013, but till now no mutually acceptable solution has been found by the participating countries.

BEPS expands to Base Erosion and Profit Shifting. BEPS refers to practices of tax planning by multinational enterprises that makes use of gaps in the linkages between different taxation systems. Using these gaps, the enterprises artificially reduce taxable income or shift profits to low tax jurisdictions in which little or no economic activity is performed.

For Example: A company ‘XYZ’ operating and earning revenue in India can show expenses related to another company situated in a tax-haven, thereby shifting its profit reducing overall taxable income in India. Most of these companies situated in tax havens are related to the parent company and are registered only to evade tax in the jurisdiction having higher rate of taxation. This leads to a huge erosion of taxes from the rightful government. Over the years India has particularly been a victim of such practices.

With respect to digital economy the avenues for BEPS are manifold. Digitalization has provided new ways of mobility of intangibles suitable for tax evasion.

Companies can conduct substantial sales of goods and services in a market jurisdiction (suppose in the Indian market) from a remote location (suppose in Mauritius) through online platform. In such a manner by fragmenting the physical operations, the opportunities to achieve BEPS highly increase. Though the sales would be taking place in the Indian market, the profit would be generated in the Mauritius jurisdiction where it will generally be taxed at a meagre or nil rate, thereby helping companies to evade tax in India.

In such a scenario, it became pertinent for India to introduce taxation of digital services in order to safeguard its revenue.

Digital market in India is growing at a rapid pace. Analyzing the online business scenario, internationally renowned financial services company Morgan Stanley has reported that the Indian e-commerce market is expected to grow to $200 billion by 2027. Therefore, India’s efforts for taxing the huge revenue being generated in its jurisdiction cannot be undermined.

India has strongly advocated source-based taxation with respect to the transactions being undertaken in the digital economy. Since, no consensus could be reached through the OECD platform for the time being, India went ahead and introduced digital tax in its jurisdiction independently.

The first such effort was taken in 2016, when India introduced an ‘EQUALISATION LEVY’ through The Finance Act 2016. The important point related to this levy are as follows:

In simpler terms, suppose Mr.X who is not a resident of India is providing services of online advertising either to Mr.Y who is residing in India and carrying on his business or to Mr.Z who is a foreign person having a permanent establishment in India, then whatever gross payment Mr.X would receive from the other two gentlemen would be taxed at 6% equalisation levy.

Thus, foreign persons or entities are the ones that would be subject to the digital tax, while Indian companies providing the same services would not be under the tax net.

As per law it was stated that it would be the responsibility of the recipient of the service (i.e. Mr. Y or Mr. Z) to deduct the equalisation levy from the amount paid or payable to a non-resident service provider of online advertising (i.e. Mr. X).

Several big companies like Google and Facebook had to pay increased taxes for the online advertising services they provided after the introduction of the equalization levy. This levy has also commonly been referred as ‘Google Tax’ as Google was the main company affected by this digital tax.

However, there were certain exemptions when the tax would not be charged, like:

In such cases, the provision of online advertisement would not attract the digital tax of 6%.

Enlargement of the scope of Equalisation Levy in 2020:

The Indian government brought in certain amendments to the provisions of the equalisation levy through The Finance Act 2020 and made them enforceable from 1st April 2020. These amendments introduced a new equalisation levy of 2 per cent on the amount received by an e-commerce operator from e-commerce supply of goods or service. This new equalisation levy has also been termed as the Digital Services Tax (DST).

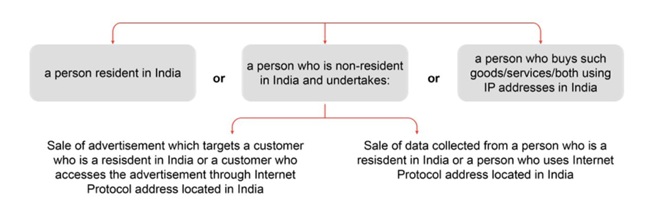

Important points related to DST can be seen as follows:

1. DST applies to a broad range of service providers, but all the Indian companies are exempted from it.

2. The range of services provided by e-commerce operator that are subject to DST can be understood by going through the broad range of definition of e-commerce supply or services. It includes the following:

3. The DST shall be levied at 2% on consideration received by an e-commerce operator from e-commerce supply of goods or services made or provided or facilitated to:

4. Payment of the DST has to be made by the digital service provider to the Indian government. It means that the non-resident e-commerce operator is responsible for the deposition of the DST.

5. As per the current provisions, transactions entered into on or after April 1, 2021 which are chargeable to equalisation levy are exempt from income-tax.

6. The DST is a prospective tax, it would not be applicable in a retrospective manner.

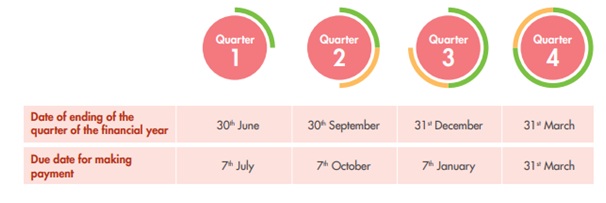

7. The digital service provider must pay the DST on a quarterly basis as per the following due dates:

8. There are three main cases when the DST would not apply:

For example: If an Indian company pays Google to advertise on Google’s search engine, that revenue would be subject to 6% equalisation levy (digital advertising tax), here DST would not apply.

But if a foreign company pays Google to advertise to Indian users on Google’s search engine, that revenue would be subject to 2% DST.

Recently, the government has also clarified that there will be no digital tax if goods, services are sold via Indian arm of foreign e-commerce players.

Let’s have a look at the controversies related to India’s DST:

Since the introduction of these new provisions from April 2020, there have been several discussions regarding the scope and applicability of the equalisation levy/DST. Certain issues that have been highlighted with regard to this digital tax can be seen as follows:

1. It is alleged that the Indian DST discriminates against foreign entities and protects the Indian entities providing digital services.

2. It is alleged that the Indian DST is extra-territorial as it is taxing foreign entities which are not under the control of the Indian government.

3. It has been argued that DST is discriminatory because it targets only the digital services, but not similar services provided non-digitally.

4. There are certain doubts regarding what actually constitutes a digital or electronic facility or platform.

5. The application of DST on the gross/entire amount of consideration received by the e-commerce operator from the customer has also led to creation of several doubts regarding the quantum of tax to be paid.

6. Compliance burden for the foreign digital entities has increased post the introduction of DST.

As the payment of the DST has to be made by the digital service provider to the Indian government, they would require to get a PAN registration. For non-residents, obtaining a PAN number can be a time-consuming process.

7. The government has provided for Income Tax exemptions for the transactions coming under the scope of DST, but the date for applicability of this provision has raised some pertinent doubts of double taxation.

For example: While the DST applies with effect from April 1, 2020, the corresponding exemption from income tax in the hands of non-resident recipient applies only from April 1, 2021. Given the same, there could be a potential double whammy in Financial Year 2020-21, where the same transaction is subjected to equalisation levy as well as taxable in India as royalty or fees for technical services

8. As per the Integrated Goods and Services Tax (IGST) Act, online services provided by foreign entities to Indian customers would be liable to IGST as well. The digital businesses thus fear that they would be subjected to huge taxation burdens by paying both IGST and DST on the online services provided by them.

Apart from these major issues, there are certain other issues as well which are lingering as no detailed set of rules for implementing the DST have been released by the Government, thereby leading to the persistence of certain unanswerable questions.

Reaction of The USA to India’s DST:

The U.S. Trade Representative (USTR) initiated an investigation of India’s 2020 Equalisation Levy (the DST) under Section 301 of the Trade Act of 1974 of USA. Under the Section 301, US often investigates economic or trade practices which it perceives to be negative and if it indeed finds the practices to be discriminatory, it then imposes certain restrictions on the country from which such practices have originated.

Conclusion:

Verifying, please be patient.