Introduction

- The Financial Stability Board (FSB) defines 'fintech' as "technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions and the provision of financial services".

- New fintech startups saw tremendous growth across India from 2015-2020, especially in digital payments, lending and wealth segments.

- According to the 'MEDICI India FinTech Report 2020', India had the second highest number of new fintech start-ups in the last three years after the US (data for China not considered).

- At present there are more than 2,000 fintech companies in India.

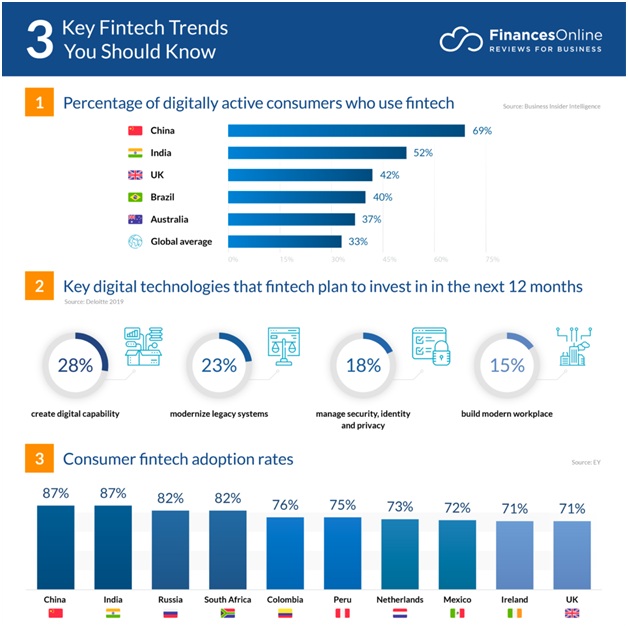

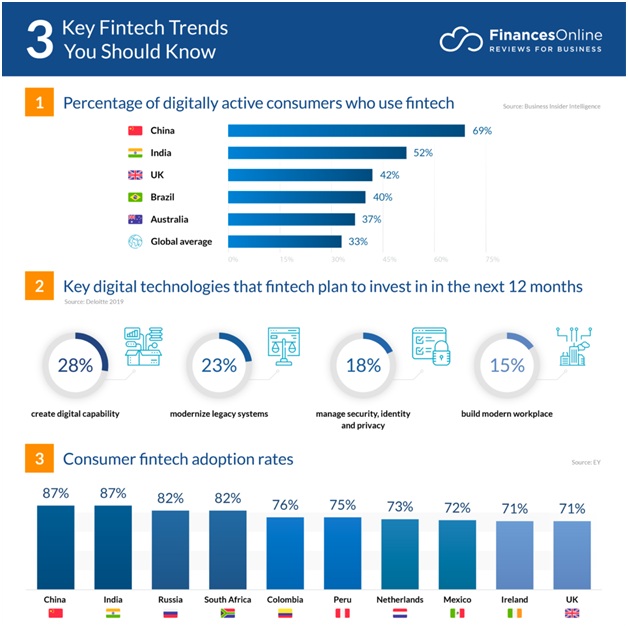

- Globally, the Fintech adoption rate of India stands at a mighty 87 percent, second only to China.

- The Boston Consulting Group in its recent report has stated that there will be a $100 billion value creation opportunity and that India is strongly poised to realise a fintech sector valuation of $150–160 billion by 2025.

- Out of 21 unicorns in India, 1/3rd are FinTech companies, Paytm being the highest valued unicorn, at $16 billion.

Fintech: key segments and business models

Initially, fintechs were mostly concentrated in payments and lending, however, growth of the fintech ecosystem has encouraged diversification of new fintech platforms in different segments.

|

S. No

|

Segment

|

Key sub-segment/business models

|

Key players (illustrative)

|

|

1

|

Digital payments

(Electronic payment solutions covering both remittances and enterprise/ merchant payments)

|

- Payment gateways and payment Aggregators

- Bill payments and money transfers

- Payment infrastructure - POS/QR codes

- Digital wallets

- P2P Payments

|

Paytm, PhonePe, BharatPe, Razorpay, Oxigen, Juspay, PayU, MobiKwik, Instamojo, Pine Labs, BillDesk, CCAvenue, Ezetap

|

|

2

|

Alternative lending

|

- Digital consumer lending

- SME financing/invoice financing

- P2P lending

- Aggregators

- Credit scoring platforms

|

LazyPay, Zest, Lendingkart, InCred, CreditMate, EarlySalary

|

|

3

|

Wealthtech

|

- Personal finance management

- Investment platforms

- Robo-advisor

- Digital discount brokers

|

Bankbazaar, Upstox, Zerodha, Scripbox, Paisabazaar, Groww

|

|

4

|

Insurtech

|

- Aggregators/policy management

- Software/white label/infrastructure APIs

- Online Insurance

- Claims management

- IoT/telematics

- Bite-size insurance/ microinsurance

|

Policybazaar, Acko, Digit, Coverfox, Arvi, Toffee Insurance, Easypolicy, BeatO

|

|

5

|

Neobanking

|

- Retail neobanks

- SME neobanks

|

Niyo, Jupiter, Finin, Neo, Kaleidofin

|

|

6

|

Enablingtech and Regtech

|

- B2B SaaS (including customer acquisition and service)

- E-KYC, AML, fraud and compliance

- Account aggregation

- Data capture and integration

- Risk management

|

CustomerXPs, SayPay, KhataBook, ClearTax, EaseMyGST

|

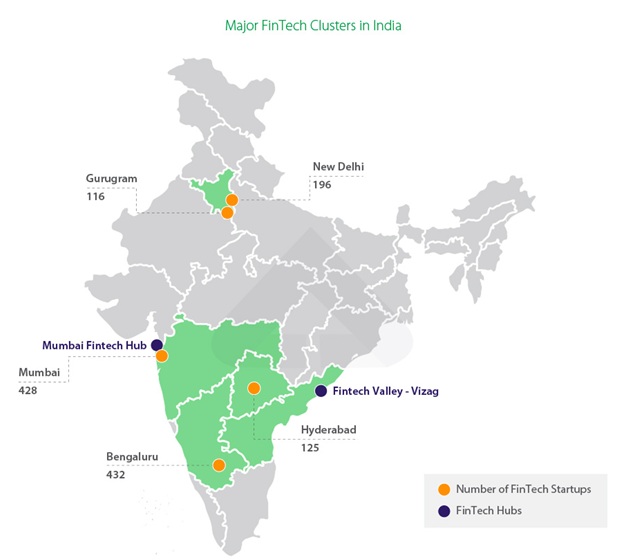

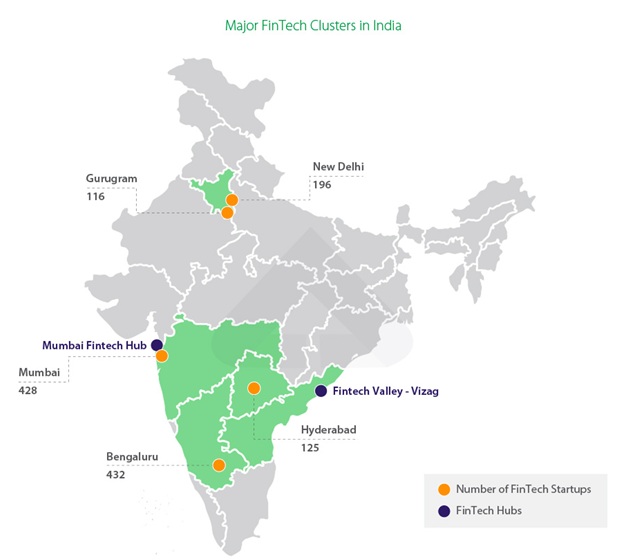

Fintech Clusters in India

Emergence of fintech start-ups

The emergence and subsequent growth of fintech startups in India can be attributed to various factors.

Some important drivers of Fintech Industry in India are,

- Availability of capital and a vibrant investment ecosystem

- One of the most difficult tasks for any entrepreneur is to raise enough funding..

- Investments in fintech start-ups have risen dramatically in recent years. Ease of capital has helped fintechs to drive innovation as well as their business model.

- In addition to private equity (PE) and venture capital (VC) investments, Indian fintechs have also benefited from the support received from various sector focused incubators, accelerators and tech-hubs.

- Most of the incubators and accelerators are either university-led, public sector-led, equity-led or financial institution-led.

- Technology and digital infrastructure

- Technology has been a fundamental enabler in the field of fintech.

- Innovations like blockchain, artificial intelligence, machine learning, biometric, robotic process automation, instant payments, internet of things, cloud computing has led to major transformations of the financial service industry.

- Availability of Infrastructure

- The backbone of the infrastructure for fintech in India has been strengthened with the host of options available to market participants such as BBPS, Bharat QR, India Stack and UPI.

- According to BCG, India's public digital infrastructure – IndiaStack, has generated strong tailwinds for the fintechs in India. The open-API infrastructure has been leveraged heavily by fintechs to address diverse use-cases and has helped fintechs in significantly reducing costs of acquisition and servicing.

- Favourable Demography

- India has more than 65% people below the age of 35 years, who have an appetite for innovative technology.

- Increased smartphone usage and improved internet penetration has also made fintechs more accessible, with about 52% of India’s digitally active people using fintech.

- This also provides a potential for larger penetration of fintech industries in untouched rural areas and small and medium-sized enterprises.

- Policy and regulatory initiatives for fintech industry in India

- FinTech entities fall within the purview of regulation by one or more of the following regulatory bodies:

- Reserve Bank of India (RBI)

- Securities Exchange Board of India (SEBI)

- Ministry of Electronics and Information Technology (MEITY)

- Ministry of Corporate Affairs(MCA)

- Insurance Regulatory and Development Authority of India (IRDAI)

- However, the RBI currently regulates the majority of FinTech entities dealing with payments, lending, other FinTech entities etc.

- The government and regulators are prima facie catalysts for the growth of the FinTech sector in India.

- Policies By Government :

- Given the fintech sector's competitive existence and overlap with other industries, effective policy and regulation are critical for the sector's growth and stability.

- India witnessed a phenomenal growth in cashless transactions with the introduction of

- Some of the recent Indian government programmes towards creating a favourable business climate for fintech companies are National Payments Council of India (NPCI), Unified Payments Interface (UPI), Jan Dhan Yojna, Startup India, Digital India Programme, Recognition of P2P lenders such as non-banking financial companies (NBFCs) and National Common Mobility Card (NCMC).

- There are tax benefits for businesses and consumers as well on e-payments as surcharges on electronic transactions stay relaxed.

- The promotion of entrepreneurial climate in the country via easy governance and policies for the start-up sector in fintech, has secured a transparent growth for online platforms offering services such as insurance schemes, personal loans, quick cash, credit cards, and more.

- By Reserve Bank of India:

- The RBI established an effective structure for a Regulatory Sandbox (RS) for fintech products, which included provisions for entry and exit of startups, duration and indicative list of innovative products, additional services available and technology which could be considered for testing under RS.

- RBI has given a boost to Bharat Bill Payments System and Unified Payments Interface along with P2P lending, digital payments etc. The use of automated algorithms has disrupted the industry and has made it simpler for consumers to utilise these facilities.

- RBI has granted 11 fintech entities licences to introduce payment banks that offer deposit, savings, and remittance services.

- By IRDAI:

- The insurance regulator (IRDAI) introduced the IRDAI Regulatory Sandbox in 2019 to strike a balance between the insurance sector's orderly growth and the security of policyholder interests, while also promoting innovation in the insurtech space. S.

- In general, Indian regulatory authorities (including RBI, SEBI and IRDA) have adopted a consultative approach towards the fintech sector and have provided a broader framework and sandbox environment to encourage responsible innovation.

The gender side of Fintech Industry

- While Fintech penetration has increased in India, the numbers show that it is not as gender sensitive as it needs to be.

- According to the GSMA’s Mobile Gender Gap Report 2021, women are 9 percent less likely to be financially included in the least developed countries and are 7 percent less likely to own a phone than men.

- In Indian cities, the percentage of women who have had exposure to the internet stands at 56 percent while the figures in rural areas are as low as 34 percent, reports the National Family Health Surveys-5.

- The UNCDF’s Inclusive Digital Economies and Gender Equality Playbook regards digital and financial inclusion as one of the key drivers for women’s economic empowerment and agency—it enhances access to income and assets, grants control over economic gains and the power to make financial decisions

- The huge numbers of startups in the Fintech industry have the capacity to mutate their models and get innovative in their reach, impact, and problem-solving efficiency. Mann Deshi Foundation is one such organisation working towards national and international level of banking and financial inclusion of rural women in India.

- In a recent example, the internet giant Google, through its Women Will platform, pledged to help 100,000 rural women entrepreneurs in financial and digital literacy

- The ‘Power of Jan Dhan: Making Finance Work for Women in India’ report states that by serving 100 million low-income women, public sector banks in India can attract approximately INR 25,000 crore in deposits while financially empowering 40 crore low-income Indians. This will not only improve financial inclusion but also provide a stable platform for Fintech companies to operate.

Challenges faced by fintech start-ups in India

In order to ensure scaling up of fintech start-ups, some of the key challenges will need to be addressed.

- Absence of fintech specific regulations and regulator

- RBI and SEBI are yet to come out with comprehensive and separate guidelines for the fintech sector and it continues to be governed by banking and securities regulations.

- Increased regulation could hamper innovation – which is a key attribute of fintech – and also drive up operational costs.

- However, regulatory coherence will support growth of the fintech sector in the long run and help in gaining customer trust – a key factor in attracting more capital.

- The key challenge for the regulator is to create an ecosystem fostering innovation, while balancing issues relating to customer protection, data security and privacy.

- Systemic risk

- According to RBSA Advisors, with the huge expansion of fintechs and the proliferation in underlying delinquencies due to the nature of the credit flow, it is imperative to have prudential regulation controlling and limiting the system-wide risk proliferation.

- Traditional banks give advances sourced from deposits, whereas fintech start-ups lend from debt funds/equity investments. Thus, the risk can permeate to various categories of people including investors, consumers and enablers.

- Data security and privacy risk

- The fintech sector has benefited the most from unrestricted data flow. The fintech industry's biggest issue is the industry's hidden cybersecurity risks which include data breaches, third-party security threats, ransomware, application security threats, cloud-based security threats, and digital identity risks.

- To combat the cyber threat and prevent hackers from gaining access to sensitive data, a balanced approach to innovation is needed to support the fintech industry's growth. A rapid digital transition has forced unprepared governments around the world to step up legislative efforts to protect citizens' data and rights.

- To safeguard the interest of the users, as per Srikrishna committee's recommendation, the Personal Data Protection Bill 2019 was introduced in the Lok Sabha to make data localisation mandatory for all sensitive personal data (PDPB).

- Fintech startups' business models are highly reliant on outsourcing technical support and cloud services to low-cost, competitive service providers.

- Due to data localisation standards proposed in PDPB, start-ups will be unable to choose the most cost-effective cloud service providers from a global supply pool.

- Data localisation would also require them to participate in product re-engineering in order to comply with complex regulations which will increase technological and operating costs.

- Limited early stage and PoC funding

- Despite the growth in overall funding of fintech start-ups, proof of concept (PoC) and early-stage funds are still limited according to Yes Bank 'India Fintech Opportunities Review' (IFOR). As part of its study, IFOR has highlighted that:

- 71% of pre-revenue and 81% idea-stage fintech startups noted 'severe difficulty' in raising funds; and

- Lack of trust and awareness

- Due to lack of technological advancements, awareness and adaptation to these FinTechs, the penetration of these services has so far remained restricted to metros and top tier cities.

- This inequality of access and its lack of rural penetration and mass adaptation in lower tier cities shall remain the major hindrance and the major growth driver as well for the sector. Till then, the reliance on local lenders and preference for cash transactions shall continue.

Impact of COVID 19 on FinTech sector

The ongoing spread of COVID 19 has profoundly impacted economies and financial systems across the world, including the provision of digital financial services and the functioning of FinTech markets.

- No uniform impact:

- FinTech firms are not a monolithic sector, but rather comprise a range of firms, which deliver different financial services, based on different business models. Therefore, the impact of COVID 19 on market performance is not uniform across FinTech business verticals or geographic jurisdictions.

- Many Fintechs, including insurtech companies, are shoring up their capital and funding from investors and lenders. Because revenues for many of them are transaction and volume based, they have implemented cost-saving measures, including workforce reduction.

- Changes due to Consumer demand

- The kind of product or service of a FinTech firm is one of the major factors that affect the funding and growth of that firm. Also, it cannot be denied that the changes in consumer demand due to the pandemic is huge.

- FinTech companies involved with banking and business to business transactions are less vulnerable.

- Digital investment management companies, retail trading and brokerage companies, health insurance, multi-line insurance are likely to face low-medium impact while trade finance, unsecured SME lending are expected to impact highly.

- Digital Payments

- Aadhaar Enabled Payment Systems (AePS) empowers a bank customer to perform inquiries, payments, cash withdrawals, and cash deposits on an Aadhaar-linked bank account using Aadhaar as an identifier.

- AePS volumes have been steadily increasing since the start of 2019. However, it grew exponentially during the COVID 19 forced lockdown, crossing 400 Mn monthly transactions in April & May 2020.

- Digital Technology Providers

- Technology providers witnessed good growth in the early Coronavirus-hit market as the traditional banking industry employed digital solutions to meet the consumer’s demands. It can be expected to see this trend in a post-COVID 19 world.

- Digital Investment Services

- According to a recent report, FinTech companies in retail brokerage witnessed some of the highest usage numbers early in the COVID-19 affected market as the volatility was at an all-time high.

- For example, Zerodha added 3 lakh accounts in March and is now averaging 1.5 to 2 lakh new customers a month, which is almost 100% more than what Zerodha was adding in the pre-COVID days.

While the overall sector continues to grow as displayed by investment sentiment, there is certainly a shift in consumer preferences witnessed due to compulsion of online transactions.

Required Measures

- Fintech is the way forward as far as the Indian banking system is concerned and the payment system is concerned.

- Banks and Fintech will co-exist to drive the ecology of money. There are benefits that Fintech brings in that banks do not inherently have and vice-a-versa. A combination of both is what brings best value for customers.

- India is not one market but a sum of various small markets. Fintech companies have to develop products for each segment rather than jumping in the same space.

- Fintech companies should take feedback from consumers in rural areas to make their applications more user friendly, with voice commands, fingerprint scanning, and increase the interoperability mechanisms.

- There is a need for strengthening cyber security. For Fintech to thrive, a strong risk mitigation framework has to be put in place.

- There is a need to increase digital and financial literacy in rural areas. For this, the government should engage civil society organisations and fintech companies within its initiatives to build and maintain trust within consumers and MSMEs regarding digital payments and other fintech services.

- As pointed out by the ‘Report of Steering Committee on Fintech Related Issues’ there should be a robust regulatory framework for consumer redress for fintech services. For this, a risk-based regulation and supervision mechanism (operational risk, financial risk, market conduct risk, efficiency risk) should be introduced.

Conclusion

The landscape of banking and financial sector has undergone a phenomenal transformation since the 2008 Global Financial Crisis, demonetization and COVID 19, owing to financial technology firms, popularly known as ‘FinTechs’. FinTech has been known for their coming-of -age technology towards offering the most convenient and flexible options for consumers. It is not surprising that going forward, financial services will offer a customized and local offering to their customers using data analytics. The more and more advances in technology financial services adapt to upgrade their strategies, more growth in this sector is foreseen. This is just the beginning of a huge FinTech market in the upcoming decade.

As more and more customers get on the digital board, FinTech’s will have to focus on building trust and consumer engagement. Especially given the time when cybersecurity is extremely vulnerable. To be critical and to stay ahead of the competition than other FinTech brands, it is necessary to focus on security along with making the procedure simple for consumers.